Trading on a

New Level

Tiebreak helps modern CFD brokers thrive with turnkey solutions, ready-to-launch trading platforms, cutting-edge tech, and expert support.

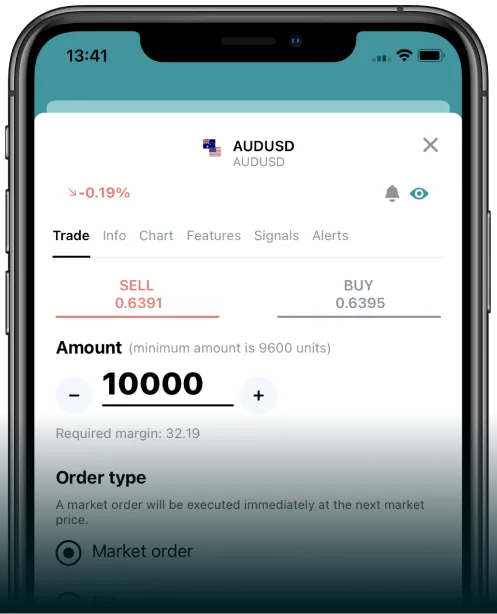

Behold the

XCITE platform

Sleek, powerful, and

built for smart trading

Double the excitement from online trading with Tiebreak’s state-of-the-art investment platform! Stay ahead with XCITE’s sophisticated tools—market updates, price alerts, and professional signals that scan the market for opportunities in seconds. Trade a wide range of assets, through a sleek mobile app designed for both beginners and experienced traders. With powerful features, real-time data, and intuitive design, XCITE takes your trading experience to the next level no matter where you are.

Excited yet? Let’s explore XCITE together!

Discover

who we are

From Vision to Victory

Tiebreak is a fast-growing, leading software company that develops a unique technology solution for online trading and direct marketing that combines a performance-based campaign optimization system, an integrated CRM system and a retention system.

Our powerful online trading platform is used by tens of thousands of customers all around the world.

Found in 2014, we have more than 150 employees in Sofia alone.

Solution

Global

Growth

150+

employees

10+

years of experience

50+

IT specialists

Check out our top products

Tiebreak’s creme of the crop!

The BOX is a web-based CRM platform for seamless sales and customer service operations, allowing real-time tracking of all client activities.

XCITE brings online trading to new heights with our enhanced features, neat design, and powerful tools!

Our expert services

Dive into the future of tech marketing solutions!

Campaign Manager

Publish, manage, track and optimize any type of online campaign, with any type of ad.

CRM Strategy

Supports the challenging human resource integration as part of online processes.

Payment Platform

Integrated with 73 Payment service providers, including 36 exotic solutions.

Data Analytics

Real-time analytics, closed-loop insights, scalable architecture to drive smarter decisions and optimize performance.

Technologies we use

Behold our world of tech!

Back-End technologies

C#; ASP.NET; ASP.NET WebApi; .NET Core; .NET 6

Front-end technologies

React JS; Typescript; Redux; Webpack

Mobile technologies

Swift; React Native; Android native; IOS

DevOps

Azure DevOps; Terraform; SaltStack; AWS; Docker; GIT; Jenkin

Databases:

MS SQL Server; PostgreSQL; DynamoDB

Carrer’s Benefits

We know how to make you feel at home!

Hybrid working model

Flexible hours

Health care and insurance

Team building

Free food

Game room

Massages in the office

Certification courses

Remuneration package

Discount program for employees

Enter our Enterprise! Join us now!

- Headquarters:

14 Charalambou Mouskou, ARTEMISIA BUSINESS CENTRE, 2014 Strovolos, Nicosia, Cyprus - Bulgaria Branch:

3, Nikola Tesla, Str. BSR 1 Building, 7-th floor, Sofia, Bulgaria 1574

Contact us if you have any questions

By clicking 'Submit,' you acknowledge that you have read and understood the Privacy Policy and agree to proceed.